Investing in precious metals has become more accessible than ever. You can now buy gold coins online from the comfort of your home. Understanding gold coin prices helps you make smart investment decisions. The market offers many options for both new and experienced collectors. Gold coins provide a tangible asset that holds value through economic ups and downs. Many investors turn to physical gold as a hedge against inflation. The process of purchasing these coins has evolved significantly over the past decade. Online dealers now offer secure platforms with detailed product information. You can compare prices, read reviews, and make informed choices without visiting multiple physical stores.

What Makes Online Gold Coin Purchases Different

Shopping for gold coins online offers unique advantages over traditional methods. You get access to a wider selection of products from various mints worldwide. Price transparency becomes easier when you can compare multiple dealers instantly. Most reputable online dealers provide detailed photographs and specifications for each coin. You can research at your own pace without feeling pressured by sales tactics. The convenience factor cannot be overstated. You save time and travel expenses while accessing competitive pricing. Online platforms often have lower overhead costs than physical stores. These savings can translate to better prices for buyers. However, you need to verify the authenticity and reputation of online dealers before making purchases.

Understanding Gold Coin Pricing Factors

Gold coin prices fluctuate based on several key factors. The spot price of gold serves as the foundation for all pricing. This price changes constantly based on global market conditions. Premiums get added to the spot price to cover minting, distribution, and dealer costs. Rare or collectible coins command higher premiums than standard bullion coins. The condition of a coin significantly impacts its value. Coins graded by professional services typically sell for more than ungraded pieces. Demand for specific coins affects pricing in real time. Popular coins like American Eagles or Canadian Maple Leafs maintain steady premiums. Less common coins might have higher or more volatile premiums. Understanding these factors helps you recognize fair pricing when you see it.

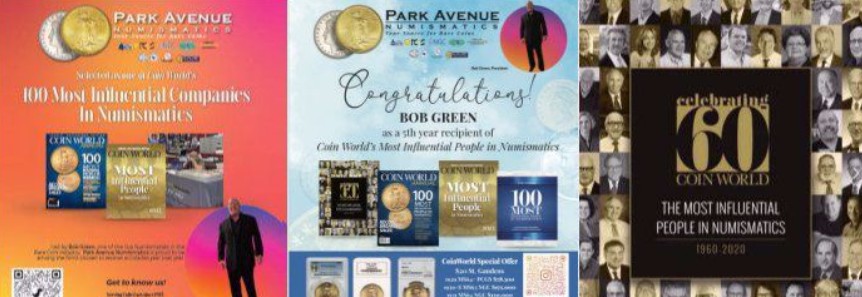

How Park Avenue Numismatics Serves Investors

Park Avenue Numismatics has built a reputation for quality service in the precious metals industry. This company specializes in helping both new and experienced investors navigate the gold coin market. They offer a curated selection of investment-grade coins with transparent pricing. Park Avenue Numismatics provides detailed product descriptions and high-quality images for every item. Their website makes it easy to compare different coins and understand what you’re buying. The company focuses on education as much as sales. They want customers to make informed decisions based on their individual investment goals. Customer service representatives can answer questions about specific coins or general investment strategies. The company maintains strict authentication standards for all products they sell.

Types of Gold Coins Available Online

The online market offers several categories of gold coins for investors. Bullion coins represent the most straightforward investment option. These coins contain specific amounts of pure gold and trade close to spot price. Popular bullion coins include American Gold Eagles, Canadian Gold Maple Leafs, and South African Krugerrands. Proof coins offer higher quality strikes with mirror-like finishes. These coins often come in protective cases with certificates of authenticity. Commemorative coins celebrate specific events, people, or anniversaries. They might carry higher premiums due to limited mintages. Pre-1933 gold coins offer historical value alongside their gold content. These older coins appeal to collectors and investors alike. Each type serves different purposes in an investment portfolio.

Evaluating Online Dealer Credibility

Choosing the right online dealer requires careful research and evaluation. Look for dealers with established business histories and positive customer reviews. Professional affiliations matter in this industry. Membership in organizations like the Professional Numismatists Guild indicates credibility. Check for clear return policies and guarantees of authenticity. Reputable dealers provide secure payment options and insured shipping. Park Avenue Numismatics exemplifies these standards with their transparent business practices. Read independent reviews on multiple platforms before making decisions. Be wary of deals that seem too good to be true. Extremely low prices might indicate counterfeit products or unreliable service. Contact customer service with questions before placing orders. Their responsiveness and knowledge reveal much about the company’s professionalism.

Smart Strategies for Buying Gold Coins

Successful gold coin investing requires strategy and patience. Start by determining your investment goals and budget. Some investors focus solely on bullion for maximum gold content per dollar. Others mix bullion with collectible coins for portfolio diversity. Dollar-cost averaging works well for gold coin purchases. This means buying consistent amounts at regular intervals regardless of price fluctuations. This strategy reduces the impact of short-term price volatility. Consider storage options before making large purchases. Home safes work for smaller collections. Bank safety deposit boxes offer more security for valuable holdings. Some investors use specialized precious metals depositories. Track your purchases with detailed records including purchase prices and dates. This information becomes important for insurance and tax purposes.

Common Mistakes When Buying Gold Coins Online

New investors often make preventable mistakes when entering the gold coin market. Paying excessive premiums represents the most common error. Some coins carry premiums far above their actual gold value. Research typical premiums for specific coins before buying. Ignoring shipping and insurance costs can surprise buyers at checkout. These fees add to your total investment cost per ounce. Failing to verify dealer credentials leads to potential scams or counterfeit products. Always confirm business licenses and industry memberships. Buying based solely on emotion rather than investment value costs money. A coin might look beautiful but carry an unjustified premium. Not understanding the difference between numismatic and bullion value causes confusion. Collectible coins trade differently than pure investment pieces. Overlooking authentication services for expensive purchases increases risk. Professional grading provides peace of mind for significant investments.

How Gold Coin Prices Respond to Market Conditions

Gold prices react to various economic and political factors worldwide. Inflation concerns typically drive gold prices higher as investors seek protection. Currency fluctuations impact gold’s purchasing power and attractiveness. When the dollar weakens, gold often strengthens in response. Geopolitical tensions create uncertainty that benefits gold as a safe haven asset. Central bank policies affect gold prices through interest rate decisions. Lower interest rates generally support higher gold prices. Stock market volatility sends some investors toward physical gold. Supply and demand fundamentals play their role too. Mining production costs set a floor under gold prices. Industrial and jewelry demand provides baseline consumption. Investment demand from coins, bars, and ETFs adds another layer. Understanding these dynamics helps you time purchases more effectively.

The Authentication Process for Gold Coins

Authentic gold coins have specific characteristics that distinguish them from counterfeits. Weight and dimensions must match published specifications exactly. Professional dealers use precision scales and calipers for verification. The sound test involves tapping coins to detect the distinctive ring of gold. Experienced dealers recognize authentic sounds immediately. Magnet tests help identify fake coins made from magnetic metals. Real gold shows no magnetic attraction. Visual inspection reveals details like edge reeding and surface textures. Counterfeiters struggle to replicate fine details perfectly. Professional grading services like PCGS and NGC provide the highest authentication confidence. These organizations encapsulate coins in tamper-evident holders with unique serial numbers. Park Avenue Numismatics ensures all coins meet strict authentication standards before listing them for sale. Buyers receive genuine products backed by the company’s reputation and guarantees.

Storage and Insurance Considerations

Proper storage protects your gold coin investment from damage and theft. Home storage requires a quality safe rated for the value you’re protecting. Bolt the safe to the floor or wall to prevent removal. Keep your gold coin holdings private to minimize theft risk. Bank safety deposit boxes offer affordable security for many investors. Annual rental fees cost far less than potential losses from theft. Specialized precious metals storage facilities provide maximum security. These depositories carry comprehensive insurance and professional security systems. Insurance coverage becomes essential as your collection grows. Homeowners insurance might not cover precious metals adequately. Specialized collectibles insurance provides better protection. Document your collection with photographs and purchase records. This documentation supports insurance claims if necessary. Update your storage and insurance as your collection value increases.

Tax Implications of Gold Coin Investments

Gold coin investments carry specific tax responsibilities that investors must understand. The IRS classifies physical gold as a collectible asset. Capital gains from selling gold coins face a maximum 28 percent tax rate. This rate applies to coins held longer than one year. Short-term gains under one year get taxed as ordinary income. Keep detailed records of all purchases including dates and prices paid. These records establish your cost basis for calculating gains or losses. Dealers must report sales over certain thresholds to the IRS. This reporting helps ensure tax compliance. Some investors use self-directed IRAs to hold physical gold coins. These accounts offer tax advantages similar to traditional retirement accounts. Consult tax professionals familiar with precious metals investing. Rules change and individual situations vary significantly. Proper planning minimizes tax burdens while remaining compliant.

Building a Diversified Precious Metals Portfolio

Gold coins should fit within a broader investment strategy. Financial advisors often recommend allocating 5 to 10 percent of portfolios to precious metals. This allocation provides inflation protection without excessive concentration. Diversify within your gold holdings too. Mix different coin types and sizes for flexibility. One-ounce coins offer convenient units for major purchases. Fractional coins like quarter-ounce or tenth-ounce pieces provide more liquidity. Consider adding silver coins for additional diversification. Silver trades differently than gold and serves different market niches. Platinum and palladium coins offer even more variety. Each metal responds to unique industrial and investment demands. Balance numismatic coins with pure bullion pieces. Collectible coins might appreciate independently of gold prices. Rebalance your portfolio periodically as prices change. This maintains your target allocation percentages.

Final Thoughts on Gold Coin Investment

Buying gold coins online has transformed how investors access precious metals markets. The convenience and selection available through reputable dealers make investing easier than ever. Understanding pricing factors helps you recognize value and avoid overpaying. Authentication, storage, and insurance require attention but protect your investment. Park Avenue Numismatics and similar established dealers provide the expertise and service investors need. Start with clear goals and educate yourself about different coin types. Research dealers thoroughly before making purchases. Build your collection gradually using dollar-cost averaging strategies. Keep detailed records for insurance and tax purposes. Gold coins offer tangible value that has endured for thousands of years. They provide portfolio diversification and inflation protection. The key lies in making informed decisions based on knowledge rather than emotion. Take time to learn about the market before committing significant capital. With proper approach and reliable dealers, gold coin investing can strengthen your financial position for years to come.

+ There are no comments

Add yours